Hello and welcome to my personal finance blog for families! I created this blog to share my journey of getting better at managing our family finances. After having kid#2, I decided to stay home to spend more time with them. That took away a significant chunk of our income and we had to learn to manage with the new reality and still be able to save for our retirement.

I was actually inspired to be more intentional about our family finances by many other finance bloggers. I was amazed and shocked when some of them shared that they survived happily on an annual expenditure of less than $24,000 for a family of 3.

I sort of took that as a challenge to see if we could do the same. So the first thing I did was to track all our family expenses in order to see how much we were spending each month.

Why I Don’t Use Personal Finance Apps to Track Expenses

Over the years, I have tried many personal financial applications such as PocketMoney, Mint, Billguard (later renamed Prosper Daily what was eventually shut down) and the recent Personal Capital.

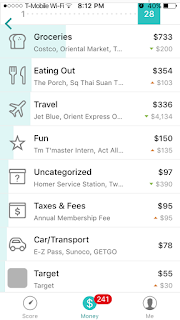

What drew me to these applications was the ability to automatically sync my credit card transactions from the banks and present me with beautiful graphs and charts of my expenditures. 90% of our transactions are put on the credit card so that should give me a pretty complete picture of our total expenses. Besides, who wants to waste time entering every single transaction if that could be automated ya?

Yet over time, I realized I was consistently exceeding my budget month after month. I figured that the main reason was because everything was automated, I was still consciously unaware of how much I had spent and there was no trigger to make me rein in my expenditures.

Furthermore, because there is often a 1-2 days delay between my spending and when the charge get processed by the credit card, by the time the charges are reflected, I would have already exceeded my budget and there is pretty much nothing else I can do, except to “accept and silently rebuke myself” for exceeding the budget again.

This passivity is one key reason why credit card companies have been so successful and why credit card can be so dangerous to your financial health. Basically, that piece of plastic is an abstraction of your money and since you are not handing cold hard cash over, you feel less of a pinch when you swipe that card. If you have to pay everything in cold hard cash, you need to first withdraw the money from the bank and every time you withdraw cash, you will be reminded of how much less money you have left.

Second, I had a problem tracking prepaid expenses. For example, the kids’ gym lessons were often billed every 10 weeks, yet it would only be reflected once in one month on the credit card bills. What happens is that it would inflate expenses in one month and give me a false sense of lower expenditures in the remaining two months. Which basically results in me over-spending in the remaining two months.

Old Fashioned manual tracking

I finally devised my own old-fashioned system using a simple Lists application. No fancy graph and charts. No fancy syncing. But our savings has been consistently going up since I started my system.

I knew I had to stay paperless because I am a mess with papers. And I knew I wanted something in my phone so I could enter the expenses once I got out of the stores.

If something had to wait until the end of the day or the end of the week, I will probably never get it done.

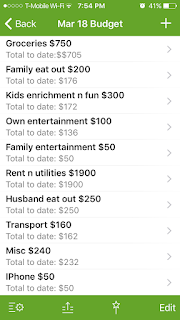

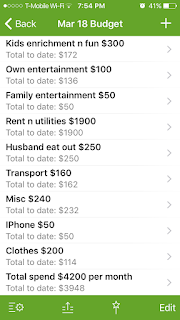

Therefore, I set up my own tracking system using the Paperless Lists App. It is a lists app that I use for notes and recipes. I created a budget template for each month.

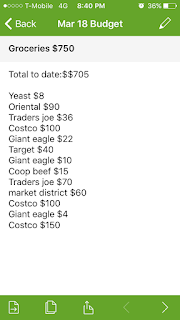

It takes me no more than two minutes to enter how much I had spent the moment I walk out of any store or restaurants. By sticking to broad categories of items, I do not waste time entering the date of transactions nor do I break down to how much that 2lb bag of apples cost.

I also just simply round the numbers up to the nearest dollars and do not bother with the pennies and cents.

The very act of recording down how much I just spent gave a very similar effect to withdrawing cold hard cash from the bank. Every transaction reminds me how much of my budget is left and forces me to reconsider each purchase carefully to make sure they are absolutely necessary and will not bust the budget.

For example, on months when we were close to busting our groceries budget before the end of the month, I would turn to clearing out our fridge and pantry instead of heading to the grocery stores because I want to keep to my budget. So what happens here is twofold, we end up with less food wastage (throwing out less expired items) and we stick to our budget. Spending is no longer a mindless activity.

Tracking expected expenses

Because it is such a simple “pen and paper” system, I was able to track my prepaid expenses more closely to obtain a more accurate average monthly expenditure number. For example, now I divide my 6-monthly car insurance into 6 and record the monthly amount of car insurances under auto expenses.

I am also able to track and add in my expected expenses (sinking funds). In this case, knowing that I would probably need to replace my iPhone every 2-3 years, I tack on a monthly $50 expenditure for iPhone. So when the time comes to getting my new iPhone, the money has already been saved up and I can happily get my new phone with a peace of mind.

So, with my new system, I do not spend based on how much money I have left in the bank. I spend strictly based on my monthly budget and I make an all-out effort to stick to my budget.

Building my own app

Recently, I got interested in building mobile applications. I started off building a kids virtual bank and chore app for myself. As I was using the KidsHomeBank app, I realize that I could adapt some of the concepts for my own budgeting app.

I had tried various budgeting app, but none worked out for me. They were often too confusing and could not display information in a way that I wanted.

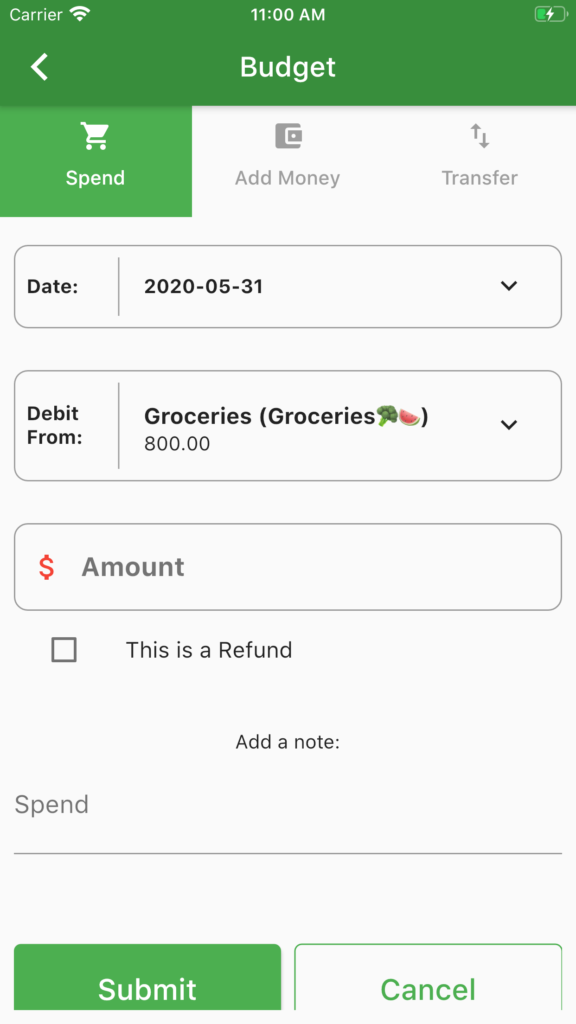

By developing my own app, it would save me the hassles of having to copy and paste a new budget template every month. It would also have a more user friendly interface to allow me to quickly track my expenses. It would automate all the calculation and I won’t have to manually add all the numbers each time! I was really excited!

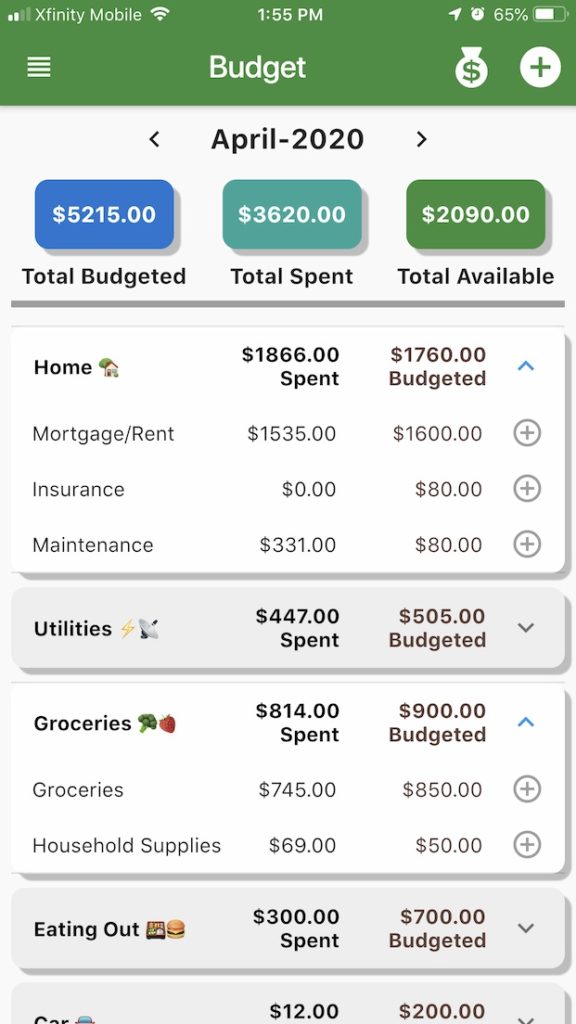

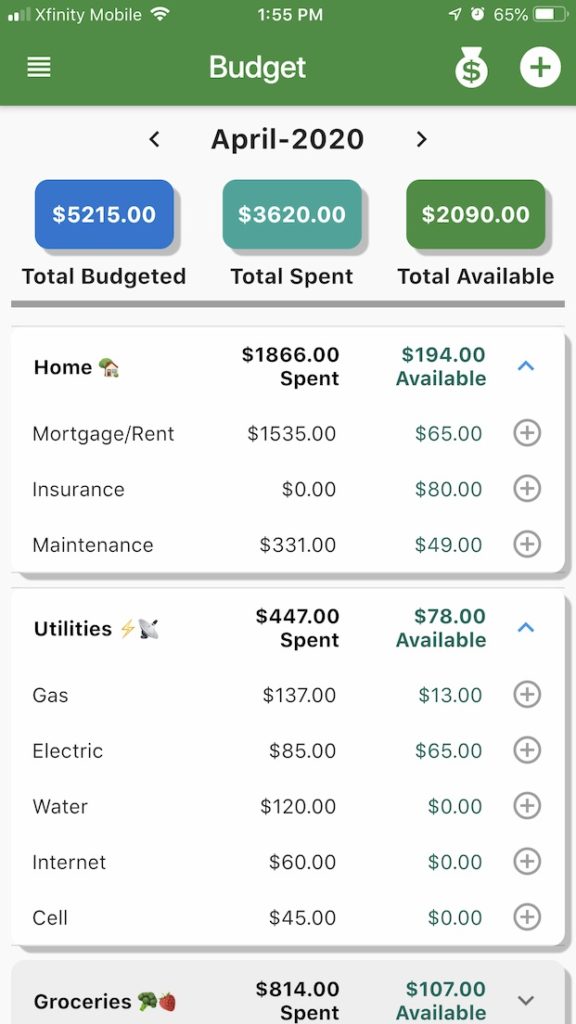

I am excited to share that my budgeting app, Budget Everything, is now available on both the iOS App Store and Google Play Store. I hope you will try it out and let me know if you like it.

I named it Budget Everything because when we try our best to budget for everything that we can possibly think of, there is less chances of surprise expenses and we can have true freedom to spend on things that matters to us.

If you do not currently track your monthly expenses, I highly encourage you to try doing so. It will do wonders for your financial health. Try it with our Budget Everything App, I hope it will help you get started in taking more control of your finances.