With the current record low interest rates, everyone is talking about refinancing their loans to save money. Our current interest rate is 4.25% and when I hear people getting rates below 3%, my interest was piqued.

This article shares some of the information that I have learned as I embark on our process to refinance our home loan. I was overwhelmed with all the quotes and information that I was getting from all the different lenders.

So I have documented and clarified my thinking here and hope it will be useful to anyone who is also embarking on the process of refinancing your home loan.

How Refinancing can Help you Save Money

I did a quick check on mortgagecalculator.org. We are currently paying 4.25% interest for our 20 year loan. With our current loan package, we would be paying $106,955.80 of interest over 20 years.

But, if the rate drops down to 3%, with the same loan term of 20 years, the amount of interest paid over 20 years drops to $72,827, 53.

Let’s go a bit further, what happens if I shorten the term by just a couple of years and get on a 15 year loan? The total interest paid now drops to just $53,460.33.

That’s almost a 50% savings!

When we are able to refinance into a lower rate, the key savings will come from paying less interest to the lender over the life of your loan. However, there are certain costs that we must pay when we refinance our loan.

Therefore, it is important that we understand what are the costs involved, to ensure that we are indeed saving more than what we pay to refinance the loan.

Costs and Fees to Refinance Your Mortgage Loan

As I embark on my process, I learned that as with all things financial, there is never a simple, straightforward answer. I wish things were as easy as just calling my bank and telling them “Hey, you guys reduced the deposit interest rate because the rates have gone down, shouldn’t you be doing the same for my mortgage loan?” ?

As we all know, that’s clearly not how banks work.

So apparently, you need to pay to refinance your loan. To make matters worse, that amount you pay is not a fixed amount. It is not a fixed price like trying to buy your favorite bag in the store and it’s not even a fixed percentage of your loan amount.

The costs and fees are known as Closing Costs.

The cost vary from lender to lender. The only way is to find out the costs is to call different banks and mortgage companies to get quotes to compare. This is the so-called “shop-around” for mortgage rates. Unfortunately, this “shop-around” is a far cry from hitting an outlet-mall to “shop-around” for your favorite shoes or bags.

How to Shop-Around for Mortgage Refinance Rate

If you google for “refinance mortgage rate” there will be a bunch of familiar sites like bankrate.com, nerdwallet.com and lendingtree.com. These mortgage rate aggregator websites collects your information and forward them to a bunch of different mortgage companies and brokers.

Once you hit the ‘Submit’ button on one of these websites, within seconds, literally within seconds, your phone will start ringing non-stop and the calls will relentlessly continue for at least a whole week.

It’s almost like a race among these mortgage companies to see who can get to you first!

They will typically start off by asking what is your main financial goal for doing the refinancing. Whether it’s to lower monthly payments or to save over the life of the loan.

Thereafter they will ask for information, like property address, name, date of birth and SSN to do a soft credit pull on you. From the soft credit pull, they will be able to see information such as your credit score, your mortgage balance and your monthly mortgage payment.

Three types of mortgage brokers

1. Pushy Mortgage Brokers

They will attempt to get you to proceed with the refinancing in that very call. They will ask the typical information and give you a certain rate. They will then proceed to convince you that this is an awesome rate that you should try to lock it in right away. The rates changes every day they say.

They will try to explain the costs and fees to you over the phone instead of offering to send you a loan estimate over the email.

In most cases, I would advise to be very careful with such pushy lenders as they tend to offer you the lowest rate but the refinancing fees and costs are often much higher than the rest.

2. Detailed but not Pushy Mortgage Brokers

Most of the mortgage brokers will fall into this category.

After getting the usual information, they will give you a rate and they will send you a copy of the loan estimate over email. The loan estimate will give you the break down of originating fees, points, fees for required services, taxes, prepaid and escrow. This way you can clearly understand how much it will cost you to refinance you loan.

Some thoughtful brokers will even go the extra mile to provide you with more than one package so you can decide if you want to pay more in points to get a lower interest rate.

From here, the challenge will be on you to go through the different loan estimates to decide which package works the best for you.

3. Straightforward and To the Point Mortgage Brokers

Lenders from this category may not even ask you for basic information. They are happy to just provide you the rates and the points that they can offer.

If you are already pretty far along with your research and know what you are looking for, these are the best.

However, if you are pretty new to the whole refinancing process, you might be left a bit lost and wondering what other information you need.

Mortgage Refinance Rates and Refinance Costs

The devil is always in the details. What I thought was a fairly straightforward process to get the lowest rate for my mortgage turn out to be such mind-boggling endeavor with no clear winner.

There are two key factors to consider here, the rate, which lowers the overall interest of the loan, and the costs to get that rate. The rate and costs are detailed on the loan estimates provided by the lender.

On the loan estimate, you will see three main category of costs. One, Origination Charges. Two, costs for Fixed Services. Third, Prepaid and Escrow costs. We will go through each of them in detail below.

1. Origination Charges And Discount Points

First, we have the Origination Charges. This is where most of the variations between different different lenders will come from.

The origination fee is the amount charged by the lender to process your application. I have seen this amount vary from $0 to as much as $1800.

Better Mortgage is the only lender that I have found so far that says it does not charge a loan origination/processing/application fee. However that does not mean they are the cheapest.

I had a quote where the lender fees was $1290, but they only charged $278.75 in points to get a 2.875% interest rate. On the other hand, it was $1,399 in points to get a 3.00% interest rate with Better Mortgage.

Th line between origination fee and discount point may be as clear cut as it seems. One is likely to be used to compensate for the other, as both are being paid to the lender. So when comparing quotes, be sure to compare discount points and origination fees together.

| Origination Items | Costs |

| Origination Fee / Application Fee / Underwriting Fee / Lender Fees | $0 to $2000 |

| Discount Points | $0 to >$4000 |

Discount Points allow you to lock in a lower, discounted rate of interest. The more points you purchase, the lower your interest rate, the less you have to pay as interest and thus the more you can save over the life of your loan.

In most cases, one point gets you 0.25% off the mortgage rate. One point also costs the borrower 1 percent of the total mortgage amount. For example, if you refinance a loan of $200,000, one point will cost you $2000. If it costs you 0 points for a 3% interest rate, you would need to pay $2000 (1 point) to lower the interest rate to 2.75%.

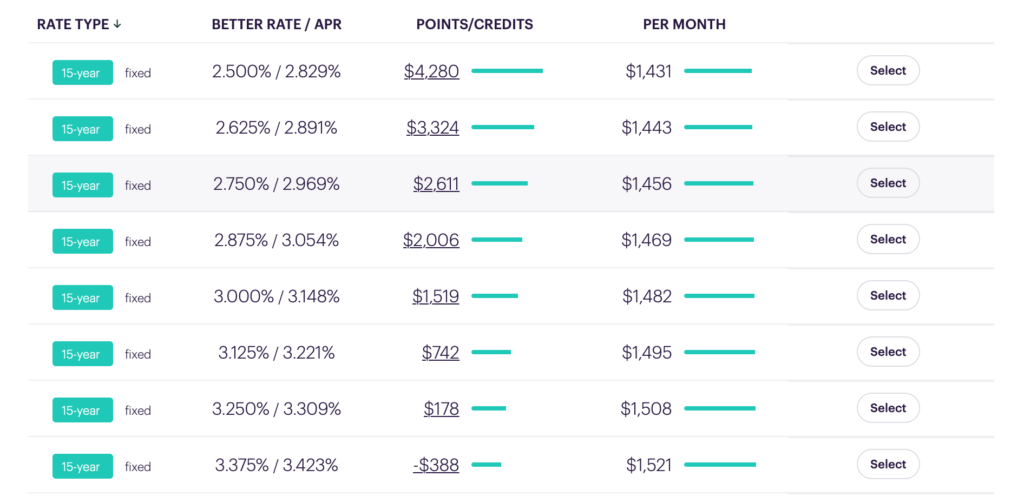

However, that may not be the case for all lenders. For example, Better Mortgage seems to calculate the points differently. Attached is a screen shot of the points and costs from better.com.

If you track the rates on better.com, you will find that the points can vary between a few hundred to a few thousands within a day.

To further complicate matters, the base interest rate for 0 points is also different for different lenders. For the same 3% rate, one lender could charge 0 points, another could charge 0.25 points or 0.125points.

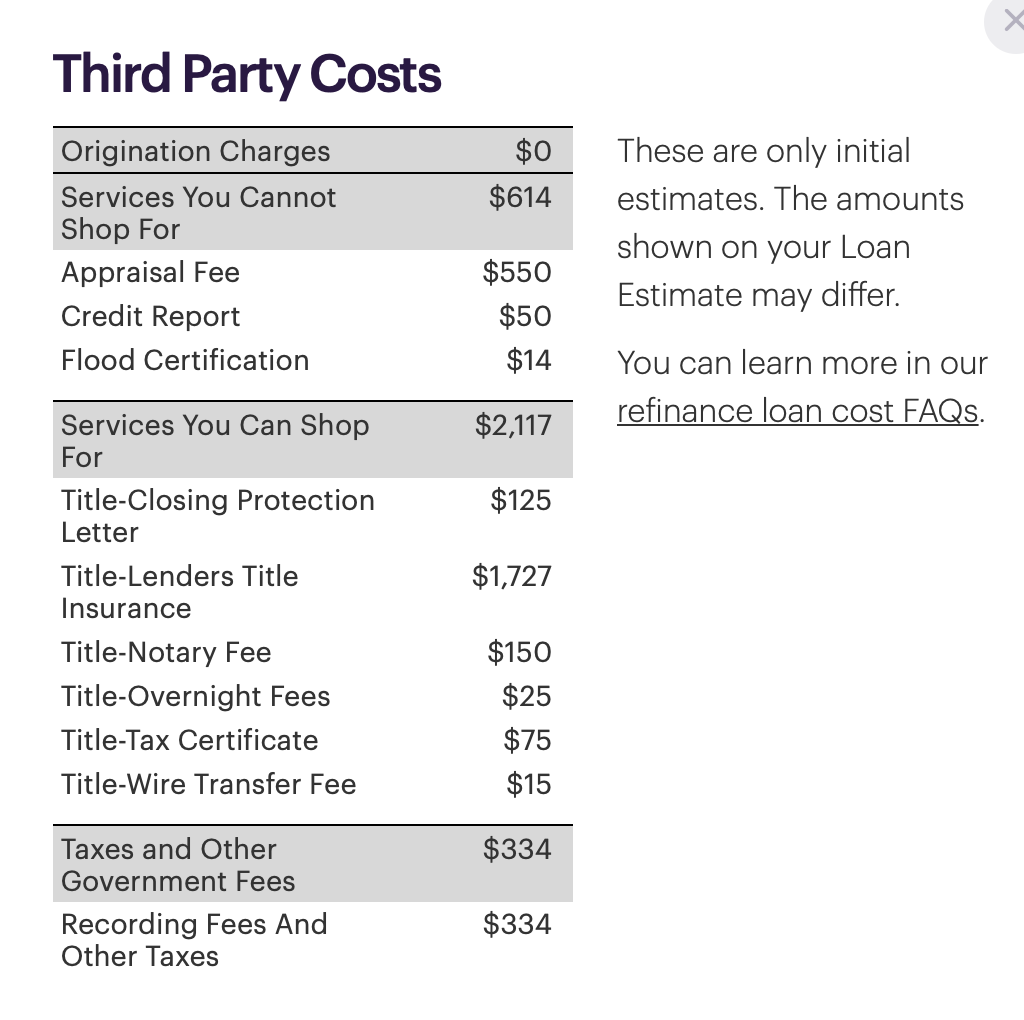

2. Fixed Services

Almost three-quarters of the costs will be on fixed services as follows. The Lender Title Insurance is the biggest chunk as it is calculated as a percentage of the loan amount. So for a $200K loan, this amount typically adds up to around $3000 – $3500.

The table below list the most standard fee in most loan package. As you can see, the prepaid expenses are pretty fixed and necessary. The costs for the title and appraisal services are also somewhat standard, although some sneaky lenders may sneak in an extra item or two here (like $200 for an appraisal rush fee). So remember to do your due diligence on the itemized charges when you go through the costs estimates.

| Services | Costs |

| Appraisal Fee | $350 to $600 |

| Credit Report | $20 – $60 |

| Flood Certification | $10 – $20 |

| Title – Lender Title Insurance | Typically ~ 0.75% of Loan Amount |

| Govt Recording Fee | $100 – $500 (or more depending on state) |

| Title (Various item including Closing Fee, Notary Fee, Wire Fee, Tax Certificate, Overnight Fee) | $300 – $500 |

3. Prepaid and Escrow Costs

Last but not least, there will be a section for Prepaids and Escrow. Prepaids is for payment of the interest for the days that your new mortgage starts and before the start of the new month. So for example, if you new loan is effective on 27 July, you would have to pay 5 days of interest on those 5 days before your mortgage payment starts on 1 August.

Escrow is an account held by the lender to pay your property, school and city taxes. Sometimes, the lender may escrow the monthly payment of your home insurance too. So these are costs you would have to pay even if you do not refinance your loan. In this case, the lender is just collecting 3-6 months ahead so they would have the funds to pay your taxes on time.

The amount here depends on how much your property taxes and home insurance are.

So this is not really a cost per se because you would have to pay them even if you do not refinance. But it is something to be aware of as you might need to come up with money upfront to cover this cost when we switch over to a new mortgage provider.

Should You Buy Points to Lower Your Mortgage Interest Rates?

Let’s run through an example, assuming a 15 year fixed rate loan for a $200,000 mortgage. We assume 3.25% as the base rate. Anything below that will require us to purchase points to lower the interest rate.

The number of months to break-even is the number of months for the interest savings to pay for the costs of the points. The numbers are calculated based on the break-even calculator here from trusty mortgagecalculator.org.

| Mortgage Rate | Points | Cost of Points | Monthly Payment (Principal and Interest Only) | Monthly Reduction compared to Base Rate of 3.25% | Number of Months to Break Even | Total Interest after 20 Years |

| 2.75% | 2 | $4000 | $1,357.24 | $48.10 | 54 | $44,303.93 |

| 2.875% | 1.5 | $3000 | $1,369.17 | $36.17 | 54 | $46,450.92 |

| 3.00% | 1 | $2000 | $1,381.16 | $24.18 | 53 | $48,609.55 |

| 3.125% | 0.5 | $1000 | $1,393.22 | $12.12 | 53 | $50,779.30 |

| 3.25% | 0 | $0 | $1,405.34 | – | – | $52,960.63 |

As we see from the table, buying points does help you to save money but only after a certain period of time. While it is may seem tempting to save almost $8,657 ($52,960-$44,303), but we should take note that this is after 20 years. And the net savings is really only $4,657 ($8,657 – $4000).

Furthermore, if we actually invest that $4000, assuming a rate of return of 6%, after 20 years, the return will be $12,828.54. This is way better than the net return of $4,656.70.

In the above example, it takes approximately 53 months, which is about 4 years and 4 months for you to just break-even on the costs of the points. So you would have to be sure that you plan on staying in the home or sticking with that mortgage for almost 4 years for it to be worthwhile to buy down those points.

Unfortunately, statistics have shown that most people tend to move or refinance their loans within 5 years of their purchase. Hence, most do not recommend you to buy points to lower your interest rate.

Therefore it is very important that you compare different refinance packages based on the same discount points. The lowest rate may not be the best as you could be paying a lot more to buy discount points for the lowest rate.

When and How Much To Pay for Refinancing

All things being equal, clearly we want the lowest rate with the lowest costs. But as explained above, with all the different varying components, things are never that straightforward. In most cases, you will probably get a lower rate with a slightly higher costs.

Furthermore, we need to ensure that the rate drop is large enough to make the refinancing worthwhile. The recommended rule of the thumb is to refinance only if the rate is at least 1% below your original rate. Let’s run through an example to understand why.

Let’s assume an original loan of $240,000, with an interest rate of 4.00% for 30 years.

| Rates (30 Year Loan) | Closing Costs (Excluding Prepaids) | Monthly Interest Savings | Number of Years to Break Even | Monthly Payments | Monthly Payment Reduction | Total Interests (20 Years) |

| 4.0% | $1,145.80 | $172, 486.82 | ||||

| 3.5% | $5,000 | ~$90 | ~ 4 yrs 7 months | $1,038.98 | $106.82 | $142,656.67 |

| 3.5% | $4,000 | ~$90 | ~ 3 yrs 9 months | $1,038.98 | $106.82 | $142,656.67 |

| 3.0% | $5,000 | ~$190 | ~ 2 yrs 3 months | $975.49 | $170.31 | $119,799.99 |

| 3.0% | $4,000 | ~$190 | ~ 1 yr 9 months | $975.49 | $170.31 | $119,799.99 |

From the above table, we see that if we refinance for a less than 1% difference, it would take almost 4 years to break even on the costs. But as we mentioned earlier, statistics have shown that most people tend to move or sell their property within 5 years of their purchase. So, if you move or sell before 4 years, there would have been no savings at all.

On the other hand, with a 3% interest rate, you can recoup the costs of your refinancing within about 2 years. And if you end up staying in the property for the next 30 years, you are saving a whopping $52,686.83 in total interests.

Zero Cost Refinancing

Didn’t I just say we have to pay some fees to get our loan refinanced? So what’s this zero-cost refinancing? If there is such a thing, why didn’t I just talk about it first?

Trust me, I too was hoping that there were such good deals in this world. But I too learned that the zero-cost refinancing is not really free. It just means that you can choose to roll your refinancing costs into your loan, so that your out-of-pocket costs can be $0.

So for example, say you have $210,000 left on your current loan and it costs $5,000 in fees to refinance your loan. If you request for zero-cost refinancing, the lender could roll the costs into the loan, so now you are taking a loan of $215,000 from them instead.

Bear in mind that you do that, you will be paying interest on that $5,000 for the life of your mortgage. So if the interest rate for you loan is 3% for a 30 year loan, you will be paying an additional $2,588.87 in interests on that $5,000 over 30 years.

One thing to note here is to make sure that your loan amount is still less than 80% of your home value. Otherwise, you would have to pay additional Private Mortgage Interest (PMI) of 0.5% to 1% on your total loan, which will reduce the benefits of refinancing in the first place.

So if you do not have to pay PMI and could potentially invest that $5,000 somewhere else for a return higher than 3%, it might be worth considering to roll your refinancing costs into your new loan.

Conclusion

Unfortunately, as with all things financial, there is never one simple clear-cut answer for everyone. Whether it is worth it to refinance you loan will depend on you current circumstances and goals.

For a start, here are some general steps to get you started and hopefully help you decide if it’s worth it to refinance your current home loan.

- Is the rate low enough to make refinancing worthwhile? Do we plan to move in the next couple of years? If you plan to move within the next 3-5years, the new rate must be at least more than 1% point lower than your current rate to make refinancing worthwhile.

You can use the refinancing calculator at mortgagerate.org to find how many years it would take to break-even on the costs of the refinancing your loan.

2. If you decide that you will be staying put for at least the next years, you can start to call around to get a few quotes. Remember the lowest rate may not be the cheapest. It is best to compare the rates based on zero discount points in order to see which refinancing package has the least costs.

3. Once you have found your preferred loan package, decide if you want to pay for the costs out of pocket or roll them into the loan.

So while this “shopping around” is no walk in the park, but if you save $50,000, all these hard work would definitely be worthwhile.