What is All Cash Budgeting?

To be honest, I was quite surprised to find that people were intentionally using cash for all their transactions. I often thought that only the older folks who grew up pre-credit card era would use cash for everything.

I mean why would you want to miss out on the free cash backs and rewards from the credit card companies.

As I later learned, all cash budgeting was something strongly advocated by Dave Ramsey because spending cold hard cash has the ability to evoke ‘emotional pain and awareness’ when you have to hand over physical wad of cash.

That emotional pain forces you to rethink your spending and hence help to rein in you expenses.

An additional benefit of all cash budgeting is that you can only spend what you have. There is no option to buy now and pay later. There is no easy way to get into debt.

So All Cash Budgeting is simply that. You withdraw all the expense you need in cash and you only spend from the cash that you withdrew.

The Dangers of Using Credit Cards

I get Dave Ramsey’s point. He is right that the piece of plastic detaches the physical and emotional link with cold hard cash. The swiping or ‘buy now’ buttons makes it way too easy to spend.

After all, everything is just a click, a swipe and some numbers. You don’t feel any pain until 28 days later when you receive your credit card bills. For a brief second, you would go… ‘how in the world did I spend so much?’, pay off that bill and cycle repeats again.

What is even worse is that they hid the predatory interest and fees behind their ‘minimum payment’ options. Which is what lead many people into debt trouble when they only pay off the minimum balance.

That crazy 20.54% APR interest rate balloon your debt into a snowball and soon you will be owing the more in interest than your original principal!

The Benefits of Using Credit Cards

While I recognize the benefits of all cash budgeting, I personally do not want to switch to all cash budgeting.

First, I am afraid I would lose my cash. Yes, I often have this image in my mind that someone will just grab me, kidnap me or rob me if they knew I had all the cash in my wallet. And how would they know? Because I would be so nervous and clutching on so tightly to my wallet and purse all the time!

Not only that, I bet with you, if I have $500 worth of notes with me, I will pull out a $20 bill and at the same time drop a $10 or $20 bill somewhere. Yes, I a klutz with paper.

Second, we use credit cards to travel hack. We enjoy traveling and also have family living halfway across the world. The travel points we accumulate from responsible use of travel reward credit cards have been extremely helpful in offsetting some of our travel costs.

Third, I am too lazy to be withdrawing cash all the time. When we first moved to Pittsburgh, Chase bank did not have any local branches in Pittsburgh. For 2 years, it was a pain trying to withdraw cash until we finally caved in to open a new bank account with a local bank.

Fourth, and most important, responsible usage of the credit cards allows you to build up a good credit score. This is important when you want to get the best mortgage rates for buying your house.

Re-creating the Emotional Pain and Awareness with Credit Cards

Cash spending alone will not help you rein in your spending. In my home country, credit card spending is not as prevalent and a lot proportions of transactions still take place with cash. I still spent more than I should.

I think the real key to having more control in your spending is 1) decide to be more conscious of what you are spending on and 2) have a plan/system to track your expenses.

The reason cash budget envelopes works is because you fund all your envelop with the maximum amount of cash you plan to spend for that category. This is you being conscious of what you are spending on.

The spending of the physical money then automatically becomes your system for your expenses. Once that money is gone, you cannot buy anything else. You cannot over-spend. This is forcing you to be disciplined in your spending.

So to re-create the success from cash envelope budgeting, we have to re-create the same triggers for 1) more conscious spending and 2) system to track your expenses and let you know how much you have left in your budget.

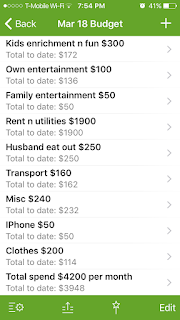

When I first started to create the system, I just did everything in a simple note app on my phone. I set up budget categories for the different expenses items. As I made any expenditure on my credit card, I would record the amount down in the app and tally up the total amount spent to date.

It was quick, easy and fuss-free. By duplicating the budget every month, I was consciously deciding how much and what I intend to spend on. By tracking every expenditure, I re-created the same emotional feeling of “having no more money left in the envelope” to spend.

If I was running low on groceries budget, instead of just going to the stores, I would just look into my fridge and pantry. Almost every single time, I would be able to find stuff to put together for a meal.

The Budget Everything App

It can be quite a hassle having to duplicate the budget for each month. The trickiest part was trying to do the mental sums to add up the ‘total-to-date’ amount as I record each expenditure.

So I tried out various budgeting app to see if there was anything that could meet my needs. Most of them were too complicated to use or required me to enter way too many fields just to track my expenses.

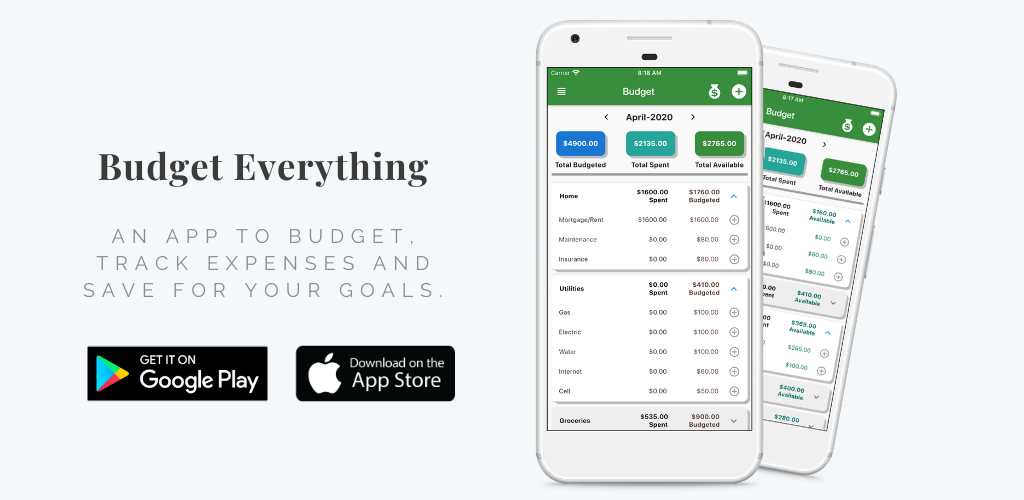

I wanted something that took no more than 3-4 clicks that let me enter the spent amount and where I spent it. So I ended up creating the Budget Everything App for myself.

Now, the monthly budget is automatically created for me each month. I can easily track my expenditure with a few clicks and I can quickly see at a glance how much do I have left in each budget category/envelope).

I charge everything to my credit card. But once I get into the car or finish my online purchase, I enter the expenditure into the app immediately. The ability to record your expenses quickly and easily is important.

If you do not have an accurate tracking of your spending, your intention to spend only what has been allocated will not be accurate. This inaccuracy will throw the whole budget system out of whack.

Conclusion

So yes, it is possible to budget successfully with credit cards and enjoy the benefits of credit card rewards, convenience and fraud protection at the same time.

But it requires discipline and mentality to treat your money as a scarce resource with a pre-determined use.

The key is to completely ignore the credit limit on your credit card and instead only spend what you have budgeted for. And always, always pay off your credit card balance each month!

If you monthly expenditure on your credit card is $3000, you will spend $36,000 in a year. With a 1% cash-back rewards credit card, you will get back $360! That $360 could be used to for Christmas presents, birthday presents or just extra savings.

This is like Santa rewarding you for a being good and disciplined with your money throughout the whole year!